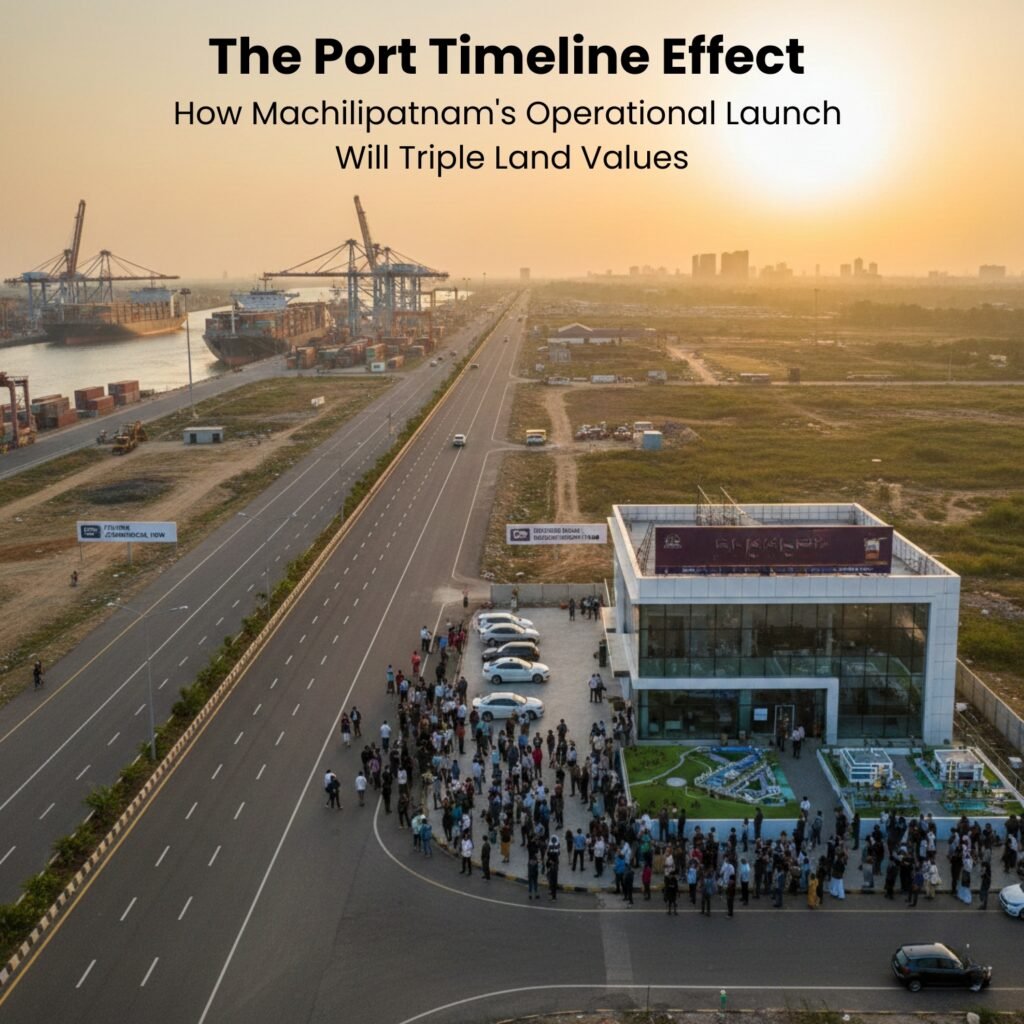

A Port Is More Than Infrastructure, It Is an Economic Trigger

When a port becomes operational, it does not simply handle cargo; it activates trade, employment, logistics networks, and long-term urban expansion. This is exactly where Machilipatnam stands today. The operational launch of the port is not just a government milestone; it is a real estate turning point that prompts many to invest in real estate before the surge begins. Historically, cities that transitioned from the announcement phase to operational port status witnessed rapid land appreciation within a short time frame. This shift is what experts call the “Port Timeline Effect.”

Understanding the Port Timeline Effect

Every port-driven market moves in stages:

- Announcement Phase – Early speculative buying.

- Infrastructure Development – Gradual appreciation.

- Operational Launch – Sharp value increase.

- Industrial & Residential Expansion – Sustained growth.

Machilipatnam is entering the most critical stage: the operational window. With construction work being fast-tracked for a 2026 commencement, local real estate investment firms in machilipatnam are noting a sharp rise in inquiry levels. Once logistics companies, exporters, warehousing firms, and ancillary industries begin functioning at scale, the demand for land accelerates quickly. Investors who enter before full commercial activity typically gain the highest upside.

Why Residential Demand Will Surge

Industrial activity always brings workforce migration. Employment opportunities create housing demand, and today’s workforce prefers planned communities over unorganized growth. This is where top open villa plots for sale in machilipatnam enter the conversation. Planned villa communities typically perform better in appreciating markets because they combine land ownership with lifestyle value. Developments offering structured layouts are expected to benefit significantly as the port ecosystem matures.

The Early Investor Advantage

One of the biggest mistakes in real estate is waiting for visible proof. By the time the port is fully operational and industries are functioning at scale, pricing usually reflects future demand. Today, those entering the market are doing so at a strategic stage—before exponential demand peaks. Early positioning allows investors to benefit from both infrastructure appreciation and residential expansion cycles. This is the window where maximum value exists.

The Ripple Effect Across the City

Port-led growth does not stay confined to one zone. As land values increase near industrial clusters, nearby residential corridors also witness appreciation. Demand expands toward premium residential areas and well-developed layouts offering long-term livability. Over time, what was once peripheral becomes central to economic activity. That is the compounding nature of infrastructure-backed development.

Why Timing Matters More Than Hype

Real estate rewards foresight, not reaction. The transition of Machilipatnam into a modern maritime hub is creating a unique opportunity for wealth creation. Buyers who plan their entry during the pre-operational stage position themselves ahead of the growth curve. As the physical structure of the port nears completion, the opportunity to secure land at current rates is rapidly closing.